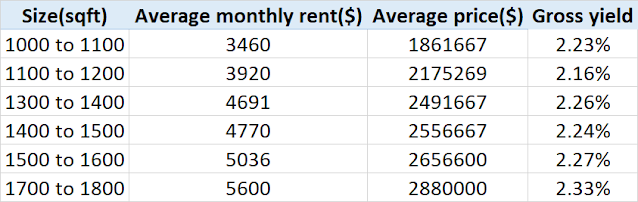

The above table are the latest 1 year transactions based on URA from September 2021 to October 2020 for a particular freehold property.

As gross yield can be really misleading, I decided to do a simple calculator, taking into account all the fees which we will need to pay.

- Additional buyer stamp duty

- Buyer stamp duty

- Seller stamp duty

- Estimate renovation and furniture

- Commission paid to agent when we sell this property in future

- Commission paid to agent when we rent out this property

- MCST fees

- Interest rates

- Property taxes

- Rental income

We made a few best case assumptions.

- Property never going to be vacant

- No replacement of aircon, lights, fridge , sofa etc for the holding period

- Earned income tax is zero. Meaning only the rental income is included in the income tax.

The calculator used is below and the property used is the one with the smallest size 1000 to1100. sqft.

I used a 10 year holding period for the new property and assumed the property did not appreciate after 10 years. Assuming i took a 30 year loan at 75% loan from the bank with an interest of 1.5%p.a, this is how the series of cashflow is.

As an investment property, one will have to have the holding power to tahan the first 10 years where the cashflow is negative.

More detailed information on how the above is calculated is found here.

The IRR( returns a year ) is only 0.75%pa.

This is ridiculous to me. I guess the hope would be for the property to appreciate to make the returns. But would interest rates appreciate too to negate the returns?

You can play with the calculator to see the outcomes of different scenarios by adding ABSD based on the number of existing property one has. As of above, the ABSD is $0 based on no existing property holding.

I made my wife an unhappy woman. Unhappy life.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.