it should be prudent to note that we are not experts, in fact, we are just "wannabes", you know..those act smart kind who always puts up their hands when the teacher asks questions but answer wrongly......so pls verify...The information is culled from various sources, such as prospectus, reuters, annual reports, analysts reports..e.t.c.

it should be prudent to note that we are not experts, in fact, we are just "wannabes", you know..those act smart kind who always puts up their hands when the teacher asks questions but answer wrongly......so pls verify...The information is culled from various sources, such as prospectus, reuters, annual reports, analysts reports..e.t.c.-------------------------------------------

The wastewater companies listed in SGX are Hyflux, Asia Environment, Sinomem, Epure and Bio-treat and they are highly dependent on the China market, with the exception of Hyflux which has diversified to MENA ( Middle-east and North Africa).

In terms of treatment methodology, Sinomem and Hyflux mostly focus on the use of membrane technology while the rest mostly focus on the use of the biological treatment. (Note: mostly is used as often they combine both membrane and bio treatments)

In very very general terms, membrane technology is generally used in pharmaceutical or electronics industry to filter out the small stuff or to recycle water, or desalinate seawater into drinking water. The biology method is generally used to treat urban water before discharging into the environment.

In very very general terms, membrane technology is generally used in pharmaceutical or electronics industry to filter out the small stuff or to recycle water, or desalinate seawater into drinking water. The biology method is generally used to treat urban water before discharging into the environment. In terms of revenue, Hyflux, undoubtedly makes the rest bite the 'dust'.

-----------------------------------------------------------------------------

-----------------------------------------------------------------------------Their customers are segregated into municipal or private enterprises ( industrial). Generally, payment terms from municipal government are longer than private enterprises and range between 6 and 18 months. But, the risk of non payment by municipals are lower. As can be seen, most of their revenue are from municipals.

-----------------------------------------------------------------------------

-----------------------------------------------------------------------------In addition, this industry is a highly competitive industry with numerous companies competing for a piece of the pie in China. In the prospectus of Bio-Treat, the following was mentioned.

Quote "Our Directors believe that there are currently more than 350 Chinese companies that are active in the environmental protection industry in the PRC, mainly in the field of water and water treatment or drinking water treatment. Our Directors expect the number of players in this market to increase to up to 1500 by 2005 and possibly up to 6000 in 2010."Unquote

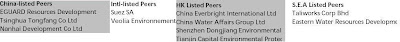

As noted by the following from DBSV 2006 report. The following are the major players. This could be useful for comparing the fundamentals.

------------------------------------------------------------------------------

------------------------------------------------------------------------------This industry is generally project based and income is non-recurring, in industry jargon, it is called "Turnkey" which means they complete the whole project from start to finish and hand it over to the customer for them to operate.

However, there is this trend towards achieving recurring income through the model of BOT ( build-operate-transfer) where the wastewater companies build the wastewater thingy as though its their own, operate it for a period of time under a contract ( 10-30years) , earn recurring income from producing the 'clean' water for the customer, and then handing the thingy over to the customer after the contract ends. Other jargon for recurring income is TOT. Aiyah, as long as you see a O in the middle means recurring lah!

-----------------------------------------------------------------------------------

-----------------------------------------------------------------------------------

Generally, for "Turnkey" projects, the wastewater companies require an initial down payment of 20%-30% before commencing on the project, with another 30% to 60% payment paid according to percentage of completion of the relevant project and terms of the contract. There is usually a retention fee of 5%- 10% of the total contract value as quality retention monies which are generally held for a warranty period of generally one year after completion ofthe installation

It should be noted that for a company to embark on BOT, they need a lot of capital to do so as they built the projects as their own. With this current 2008-2009 credit crunch, where funding is difficult, many such BOT projects are stalled.

-----------------------------------------------------------------------------------

-----------------------------------------------------------------------------------Generally, for "Turnkey" projects, the wastewater companies require an initial down payment of 20%-30% before commencing on the project, with another 30% to 60% payment paid according to percentage of completion of the relevant project and terms of the contract. There is usually a retention fee of 5%- 10% of the total contract value as quality retention monies which are generally held for a warranty period of generally one year after completion ofthe installation

Again Hyflux leaves the rest in her wake with a collection period of only 49 days.....In terms of inventory turnover period, Epure is doing pretty well....

------------------------------------------------------------------------------

Let us look at their profitability ratios based on only 1 year.

Epure seems to be doing pretty decent and has quite a lead among its peers in terms of Net Profit Margin. Gross Profit Margin is purposely placed their as this ratio has not undergone layers of 'possible' manipulation by the management. Anyway, its reflective of the "room" they can play with in case their cost of sales ( direct raw materials go up).

Epure seems to be doing pretty decent and has quite a lead among its peers in terms of Net Profit Margin. Gross Profit Margin is purposely placed their as this ratio has not undergone layers of 'possible' manipulation by the management. Anyway, its reflective of the "room" they can play with in case their cost of sales ( direct raw materials go up).--------------------------------------------------------------------------------------

In our opinion, this kind of business requires a lot of customisation as every customer is unique, depending on the local regulations, specific type of pollutant produced or environment, so its quite a tough business to be in.

Though one can take comfort in the Chinese Government's strong push for better enviromental legislation and their increase in investment budget for this sector as spelt out in their 11th Five-Year Blueprint (2006 to 2011) issued in March 2006.

So should you invest in this sector, you decide!

If you like this blog, do help SGDividends by adding us as your favourites via this link,THANK YOU!:

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

This comment has been removed by a blog administrator.

ReplyDeleteHi Sg dividends,

ReplyDeleteAs you had mentioned in your article, the increasing competition in the waste water treatment industry.No wonder I see that Hyflux had spent a lot in their investing activities.

Such companies I believe need financing activities from time to time.

As I am a newbie, I like to check with you something;

Is it ok for a company's operating activities to be negative cashflow due to a huge change in working capital as it has been expanding aggressively over the past few years?

Secondly, is it the lower the better for both receivables collection period and inventory turnover period?

thanks

Simpson

Hi Simpson,

ReplyDeleteFor your first question, think some people will say its ok to have a negative cashflow due to a huge change in working capital....its actually quite symblolic of a growth company....Also, for example, Hyflux MAY expect the China stimulus to throw it some projects.....so they are investing in more inventory and thereby resulting in cash outflow due to changes in working capital.. However, in our opinoin...if the cash from operations over the years are consistently negative..then something is wrong right, since they are spending money more than they earn from their core business....

For your second one.....receivables period smaller is better....it means they collect money faster.....

Inventory period smaller is better...it means they dont tie up too much cash in their inventory as the inventory gets used up faster....

SGDividends

If you look at Salcon's results (under Boustead), you will see that it's hard to turn such a business around, margins are thin and competition is stiff.

ReplyDeleteHi Musicwhiz,

ReplyDeleteDidnt know that Boustead had a wastewater dividion under Salcon ( dont hold that stock, nether looking at it)....

Very detailed and interesting writeup you have on them and other companies. =)

Yeah it seems this sector is also plagued with payment collection problem as Salcon experience in Phillipines....

SGDividends