Just to say:

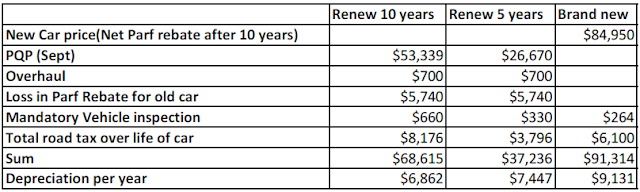

Annual road tax increases by 10% every year till the 5th year. 5th year onwards, it will remain at 1.5 times times the original road tax.

Mandatory vehicle inspections is required yearly for old cars while brand new cars only need to do inspections on the 3rd,5th,7th and 9th year.

As i am able to use full cash for all three options, interest payments on car loans will not be included. Insurance will also not be included. In my opinion, old cars only need third party insurance as if one encounters a major accident, just scrap the car and get back the prorated COE. If interest payments and insurance is included in the calculation, buying a brand new car will be much more expensive as comprehensive insurance and loans are normally required for brand new.

Renew 10 year VS Brand new car , i save $2270 per year.

New 10 year VS renew 5 year, i save $586 per year.

Some may say that the higher upfront cost ( $26,670) i fork out for renewing for 10 year vs renewing for 5 years would have lost me interest if i were to put in fixed deposit for 5 years or the likes of a risk-free investment and negate the $586 in yearly savings. But i see the option to renew anytime for 5 more years as valuable since COE can swing from $1000 to $90,000 and 5 years from now has a very high probability of a much much higher COE, looking at the COE cycle.

Just writing to straighten out my thoughts.

It will be more prudent to ditch the car and opt for public transport.

ReplyDeleteBen