TODAY published an article on 3 December 2008 on the sale of Singapore Food Industries to Singapore Airport Terminal Services ( SATS). . The Editor used the market capitalisation of Singapore Food to state whether the sale price was at a discount or premium.So is market capitalisation a good measure of whether an acquisition is cheap or expensive?

TODAY published an article on 3 December 2008 on the sale of Singapore Food Industries to Singapore Airport Terminal Services ( SATS). . The Editor used the market capitalisation of Singapore Food to state whether the sale price was at a discount or premium.So is market capitalisation a good measure of whether an acquisition is cheap or expensive?Let's give an example, if 2 slaves each cost $4. ( just for simplicity sake lah...we hate slavery...don't be soooo uptight!). If one slave has a debt of $1 but another has a debt of $3. If a master was to buy a slave and he has to pay back the debt owed by the slave, which is actually a more expensive buy? Of cos the slave who has a debt of $3 is the more expensive buy. On the same token, if one slave has $1 dollar in his pocket and the other has $2 in the pocket. When you buy a slave, you get his dollar in the pocket. So in this instance, the slave who has $2 in the pocket is a cheaper buy as you get to pocket the $2. So let's use this concept to measure whether the buy price of Singapore Food is cheap or not, shall we?It is actually a well used concept with a jargonic name called Enterprice Value.

Enterprise Value ( EV) = Market Cap + Debt - Cash

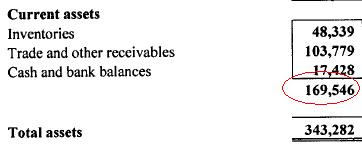

Debt = $74,968,000 (ABOVE)

Cash = $17,428,000 (ABOVE)

Cash = $17,428,000 (ABOVE)  From above, it is stated that 69.68% represents 359,731,154 shares. This means the number of shares outstanding for Singapore Food is 516,261,702 (100%)

From above, it is stated that 69.68% represents 359,731,154 shares. This means the number of shares outstanding for Singapore Food is 516,261,702 (100%)Calculating...........

Enterprise value = 516,261,702 X 0.89( Using the price given in the above TODAY article) + 74,968,000 - 17,428,000 = 517,012,915

Therefore, the theoretical cost of the acquisition if we based on market-determined price of 89 cents listed on the Singapore Stock exchange in TODAY's article should be $517,012,915. If we divide it by the total number of shares = 517,012,915 / 516,261,702 = $1.0015 per share.

The cost of the acquisition to SATs if they are able to acquire all the shares in the market place based on last done market- determined price of 89 cents on the Singapore Stock Exchange in the TODAY paper above is therefore theoretically ( academically) actually $1.0015 per share. Mainstream media states 93 cents as the price paid per share.

But what is the true true true true true true true cost that it paid? Since SATs paid 93 cents. Based on the below calculation,

516,261,702 X 0.93+ 74,968,000 - 17,428,000 = 537663382.86

537663382.86/ 516,261,702 (shares)=$1.04 per share!!

(This article has been heavily edited after contributions from readers. SGDividends SUCKS!! )

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team