We were shopping with Barber for groceries and was at the coffee beverage section of Giant. A couple was quarreling over which brand of coffee was better Super 3 in 1 Instant Coffeemix or Gold Roast 3 in 1 Coffeemix. They were at it for 10 minutes while, we, the ever kaypoh and bo liao people, pretended to be looking at some Lee Kum Kee Oyster Sauce, but we were eavesdropping on the couple's war of words. They finally chose Super..the guy's favourite. The girl seemed to walk off in a huff. Tsk Tsk, such an ungentlemanly guy.....come on..its just coffee dude.

We were shopping with Barber for groceries and was at the coffee beverage section of Giant. A couple was quarreling over which brand of coffee was better Super 3 in 1 Instant Coffeemix or Gold Roast 3 in 1 Coffeemix. They were at it for 10 minutes while, we, the ever kaypoh and bo liao people, pretended to be looking at some Lee Kum Kee Oyster Sauce, but we were eavesdropping on the couple's war of words. They finally chose Super..the guy's favourite. The girl seemed to walk off in a huff. Tsk Tsk, such an ungentlemanly guy.....come on..its just coffee dude.So just what is so special about coffee that can cause couples to quarrel? Our curiosity was

aroused and we decided to buy both and give it a try. ( Barber, you still owe us 20 cents, dont forget to return...this is not OCBC smartchange ok..)

aroused and we decided to buy both and give it a try. ( Barber, you still owe us 20 cents, dont forget to return...this is not OCBC smartchange ok..)We tasted both and Barber liked the Super but we liked the Gold Roast. And then it happened again, another quarrel. But since Barber was a beefy person, we decided not to make him too angry by arguing too much. We decided on a fair way of winning this argument, to look at the financial statements of the companies of these 2 brands Viz Branz ( Gold Roast) and Super Coffeemix( Super).

We decided to look at how strong the company is, in relation to its customers. We looked at the Accounts Receivable Turnover Ratio(Revenue/Average Accounts Receivable) to see which company was taking a longer time to collect their money from customers. A higher ratio implies its collecting money faster which is good. (See above second chart) Viz Branz started out pretty worse off than Super Coffeemix but is catching up and is nearly as good as Super in 2007...a good sign of improving management ability.

Next, we decided to look at how strong the company is, in relation to its suppliers. We looked at Accounts Payable Turnover Ratio ( COGS/Average Accounts Payable) to see which company had better purchasing terms from its suppliers. A lower ratio means a company can take a longer time to pay off its bills to the suppliers.( See above third chart) Super Coffeemix seems better in this metric and seem to be in a stronger buying power or having better supplier relations compared with Viz Branz.

So who is better? Super Coffee Mix or Gold Roast. You decide!

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

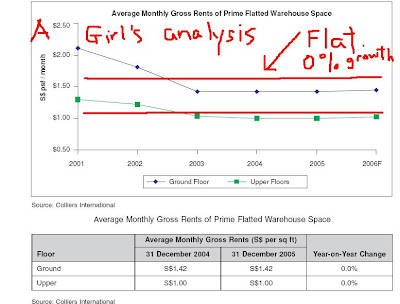

Based on Colliers International data above, it is logical to assume that the rental income growth rate g of industrial properties is 0%, by looking from 2001 to 2006F. ( just a cursory glance, she did not do a regression line. Keep it simple. It looks negative actually but let's be nice.).

Based on Colliers International data above, it is logical to assume that the rental income growth rate g of industrial properties is 0%, by looking from 2001 to 2006F. ( just a cursory glance, she did not do a regression line. Keep it simple. It looks negative actually but let's be nice.). Based on the above from SGX, the average dividends, D, of Cambridge Industrial Trust for 2007 and 2008 is $0.0616.

Based on the above from SGX, the average dividends, D, of Cambridge Industrial Trust for 2007 and 2008 is $0.0616.

Using Excel spreadsheet and plugging in the values, the Fair Value (V) for a Cambridge Industrial Trust share is $ 1.00341. Thats the maximum amount one should pay and it assumes that Cambridge is able to sustain the average occupancy of its premises currently. It also assumes that the rentals do not drop and stays constant. It also assumes no exceptional things like volcanic eruptions or earthquake or fire or Tsunami or Terrorist attack happens on any of its site. So the market price currently as of close 28 Nov 2008 is $0.205. Is it enough for you?

Using Excel spreadsheet and plugging in the values, the Fair Value (V) for a Cambridge Industrial Trust share is $ 1.00341. Thats the maximum amount one should pay and it assumes that Cambridge is able to sustain the average occupancy of its premises currently. It also assumes that the rentals do not drop and stays constant. It also assumes no exceptional things like volcanic eruptions or earthquake or fire or Tsunami or Terrorist attack happens on any of its site. So the market price currently as of close 28 Nov 2008 is $0.205. Is it enough for you?