( She is really quite interesting and surprising!And she like to determine the Value of anything. For example, she even determines the value of playing tennis vs spending time with us and she comes up with a figure.) Anyway, she told us that her teacher says females are better at investing and guys suck cos guys monitor the stock market too much and think too much and rationalise too much. She also told us her teacher says its the female species that will bring the world out of recession cos her species spend and spend and spend and spend. We got to admit she is right. Just go to a shopping center near you and see who are the ones spending? Its the girls......

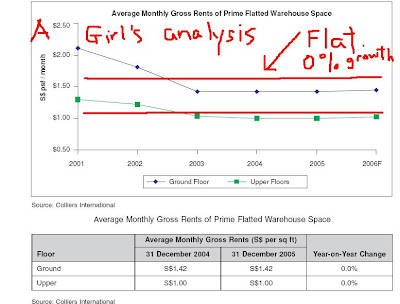

( She is really quite interesting and surprising!And she like to determine the Value of anything. For example, she even determines the value of playing tennis vs spending time with us and she comes up with a figure.) Anyway, she told us that her teacher says females are better at investing and guys suck cos guys monitor the stock market too much and think too much and rationalise too much. She also told us her teacher says its the female species that will bring the world out of recession cos her species spend and spend and spend and spend. We got to admit she is right. Just go to a shopping center near you and see who are the ones spending? Its the girls......Ok let's understand how our SEXY VJC student determined the maximum value of Cambridge. Any amount paid more for Cambrige, you are likely to lose money. ( based on Discounted Cash Flow analysis, excludes Market Irrationality).

Now, let's look at the average number of years that the assets of Cambridge Industrial Trust have to their expiry as all of them are leasehold except for Lam Soon Industrial which is Freehold. (We will assign 999 years to this freehold property. This is just a judgement call.)

Analysis done by The SEXY VJC GIRL (Aspiring Future Venture Capitalist- who wants to hire her as an intern?)

Important: The objective of the articles in this blog is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

Oh damn! your analysis is hilarious! keep up the good work.

ReplyDeleteHi SGDividend,

ReplyDeleteDoes this sexy Victorian girl really exists?

Hi Derek,

ReplyDeleteYes, she exists and she is gonna be the greatest investor in the future.

Hi SGDiv,

ReplyDeletewhow cool. More sexy Victorians please. ;)

Hi SGDiv

ReplyDeleteLOL! I like the combination of SEXY and Girl with Investments. Usually hard to find such articles in blogs about investment and money.

As hardwarezone forummers are wont to ask, peektures because SIC! (Sharing is caring!) or GPGT, "got picture, got talk".

Be well and prosper.

Hi PanzerGrenadier,

ReplyDeleteThe reason for not revealing such a GEM as our SEXY VJC girl is exacerabated by the following breaking news!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Home > Breaking News > Singapore > Story

Dec 4, 2008

Man preyed on young girls

By Sujin Thomas

GRABBING and gagging one girl with his bare hands, forcing another to undress, the man preyed on these young girls in the Housing Board flat lifts in Choa Chu Kang twice in October.

On Thursday, 19-year-old chef Tan Boon Ann pleaded guilty to outraging the modesty of the two girls in a district court.

He was sentenced to four years in jail and six strokes of the cane.

The court heard that on Oct 6, an eight-year-old girl entered a lift together with Tan, pressing the button for the 7th floor. Tan pressed the button for the 11th floor.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~`

Anyway on a serious note, confidentiality is great for this blog. The reason being that we get speak freely and independently and not be worried about being ostracised by people who can't accept people who have different views. See how much flake Xiaxue or Dawn Yang has been getting from being overly exposed....SEXY girl still has to go to school....for an eye feast, go www.dawnyang.com..=)

Nice Financial Freedom Newsletter you wrote by the way =)

Sgdividends

ReplyDeletePoint noted. Chio-bus rulez.

Hi Sgdividends,

ReplyDeleteVery interesting topic here LOL! I'm not very smart, but can you help me to ask her these questions?

The reason why she choose CIT to value is just random right? Or she likes the business?

Did she look at CIT's financial statements for analysis?

Cheers!

Hi Cheng,

ReplyDeleteDon;t think the Sexy VJC girl looked at the financial statments. She just wanted to practise her AP/GP skills and took something to value. Think its bcause she read from a Singapore Blogger that he recently bought some Cambridge shares and he was taking about Islamic finance helping it or something.

The above article is just based on DCF assuming Dividends are still ongoing and that the company will not collapse, which have to be seen from the financial statements.

All she used was the IPO prospectus, SGX dividends announcements, and the company website to see the expiry dates of the buildings.

ReplyDeleteHi SGDividends,

ReplyDeleteIf she had looked at the balance sheet of CIT, she would notice a glaring red flag.

Total debt more than market capitalization, of which 90% is due by 2009.

Anyway, is she for real? :D

Cheng

Hi Cheng,

ReplyDeleteThanks. We ( not Sexy Victorian) looked at it and indeed there is quite a red flag.

Thanks for pointing it out. We will write a short post on it =)

Well I seriously enjoy reading. I would like to say that beating the market is not easy way. In fact, it’s very, very hard. So please do safe your investment side.

ReplyDeletebest dividend stocks Singapore